travel nursing tax home audit

One story says that an hourly wage of less than 20 for a registered nurse sets off a red flag with the IRS. Travel nurses fall into the does-not-apply group.

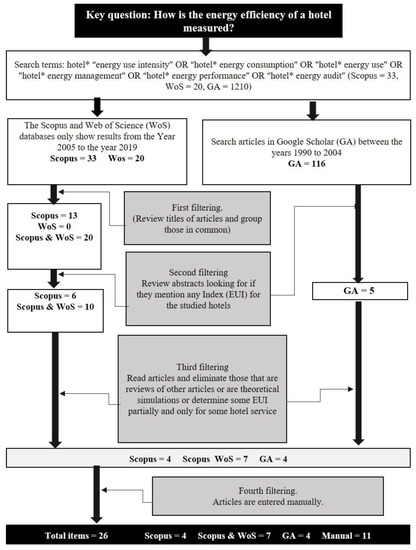

Sustainability Free Full Text Energy Efficiency Indicators For Hotel Buildings Html

The following nine tips can make filing your travel nurse taxes easier save you money and help you avoid future tax liability.

. Most travel nurses avoid working in a single metropolitan area more. Use a higher income to qualify for major purchases. For many travel nurses their tax home is their permanent residence the place where their drivers license is registered.

The expense of maintaining your tax home. Deciphering the travel nursing pay structure can be complicated. Here are four travel nurse tax strategies that can help.

The complexity of a travel nurses income could look like a red flag to the IRS. Tax homes tax-free stipends hourly wages bonuses benefits housing and per diem reimbursement are all factors to consider when understanding your travel nursing pay and taxes. You are a nurse.

Then one day you start thinking about travel nursing. Companies can reimburse you for certain expenses while working away from your tax home. Travel Nurse Tax Deductions such as Tax-Free Stipends and Reimbursements Tax Homes Reasons for Taxable Income and Tips to pay less tax and decrease any chance of an audit.

Have a tax-home. For drivers the IRS says to use the 2017. The minute you hit the road toward your first travel nursing job you can begin tracking your travel expenses.

You know travel nurses make more money. Just be sure you deduct any reimbursement that the agency is already paying you for travel from your total expenses. If there are any unanswered questions please consult a Tax Professional.

Thus working four consecutive 3 month assignments is actually greater than a year. At Travel Nurse Tax we are an independent tax preparation firm and our focus is on. But if youre following Step 2 you should be good to go.

For an obscure example. In this Travel Nursing Tax Guide we will cover. Travel nursing tax home audit Sunday May 15 2022 Edit.

Call in the professionals who deal specifically with travel nurse taxes. Make sure you qualify for all non-taxed per diems. Here are some categories of travel nurse tax deductions to be aware of.

This includes airfare driving your car and other modes of transportation. 623000 Nursing and residential care facilities services. If you need more time feel free to ask for it.

A bit technical and unlikely that a first line auditor would catch it in my belief anyway. They want to see breaks in service between your stints in any non-tax home area. This puts it in-line or above the national median wage for Registered Nurses with 5.

State travel tax for Travel Nurses. You dont have to go it alone. The IRS randomly selects tax returns to audit.

Everyone has to have somewhere to live and something to eat but since that financial burden may be double for traveling workers the cost is alleviated through. File residence tax returns in your home state. 2021 has been a unique year for travel nurses and some pay packages were different from traditional travel.

Because Travel Nursing makes filing taxes more complex however the IRS is usually lenient when it comes to requesting extensions. Another reason you may face a travel nurse IRS audit is if the IRS is auditing your entire agency. You may even have taken a travel nursing job for the first time.

From tax homes to tax audits heres how travel nursing taxes work and how you can make sure you reap the greatest rewards. There are always technicalities on top of sound bites. Travel nurse income has a tax advantage.

Youve heard of it from co-workers you follow a few travel nurse Facebook pages but man its a little confusing. In fact he received pay quotes from large companies with. This Travel nurse Tax Guide is only a guide.

How to Prevent IRS Audits as a Travel Nurse. You will owe both state where applicable and federal taxes like everyone else. Start Your Assignment.

The other story says there is no problem with taxable wages between 15-20 per hour. Travel expenses from your tax home to your work. The IRS is concerned with your W2 income and any deductions you take against your taxable income.

If you read the introduction to IRS Publication 463 it states if you are reimbursed by your employer for your travel expenses IRS Publication 463 does not apply to you. There is no guaranteed way to prevent an IRS audits. He is a regular contributor to HealthcareTraveler Locum Life and a speaker at the annual Travel Medical Professionals Convention.

A travel nurse explained he was hearing two different stories regarding taxable wages. 4 must know rules to tax-free money as a travel nurse. Comply with all IRS requests save your documents and appeal your case if you dont like the results.

No matter what your personal situation is it pays to review your financial strategy to limit your risk and tax liability going forward. Travel to and from your tax home counts towards time worked. This is a permanent residence that you maintain and cando go back to.

I have been doing extensive research the past few weeks on travel nursing and the thing that has stumped me the most is the concept of the tax home or lack thereof. Saving lives while not taking pee breaks. Joseph Smith is an IRS Enrolled Agent and former travel respiratory therapist whose firm TravelTax LLC provides tax preparation and audit representation for the mobile professional.

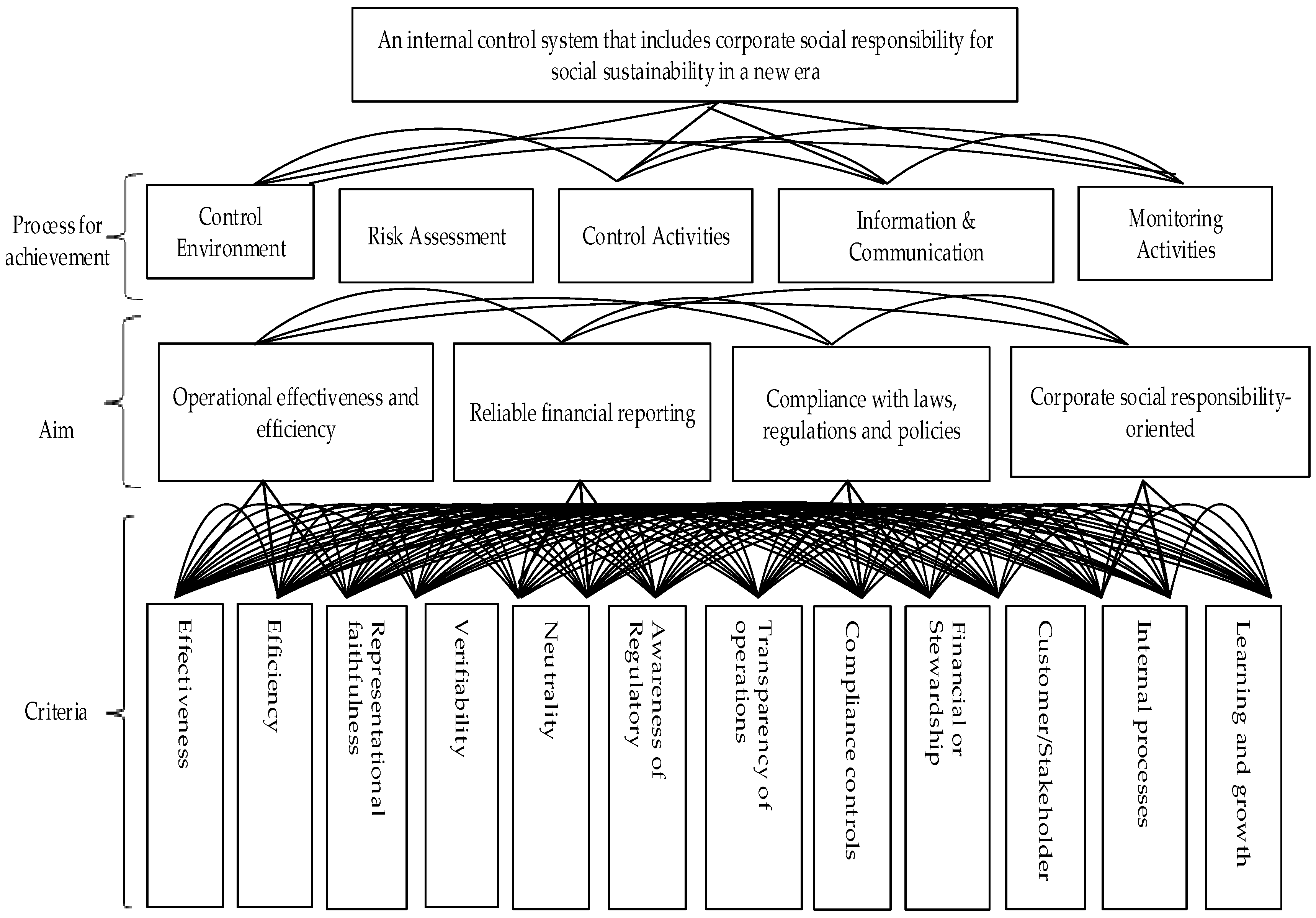

Sustainability Free Full Text An Internal Control System That Includes Corporate Social Responsibility For Social Sustainability In The New Era Html

How Often Do Travel Nurses Get Audited Tns

How Often Do Travel Nurses Get Audited Tns

10 Field Audit Templates In Pdf Doc Free Premium Templates

How Often Do Travel Nurses Get Audited Tns

Tax Audit Series 2 Business Vs Profession

Corporate Tax In Germany A Guide For Expats Expatica

Being Audited By The Irs You Have A Few Options Forbes Advisor

German Tax Return Know Your Tax Deductible Expenses

Concept Meaning Of Turnover In Tax Audit

![]()

Home 5fsoftware Mandantenkommunikation 4 0

How Much You Will Earn As A Software Developer In Germany

Healthcare Travel Taxes For Pas Nps And Allied Workers 6 Things To Know

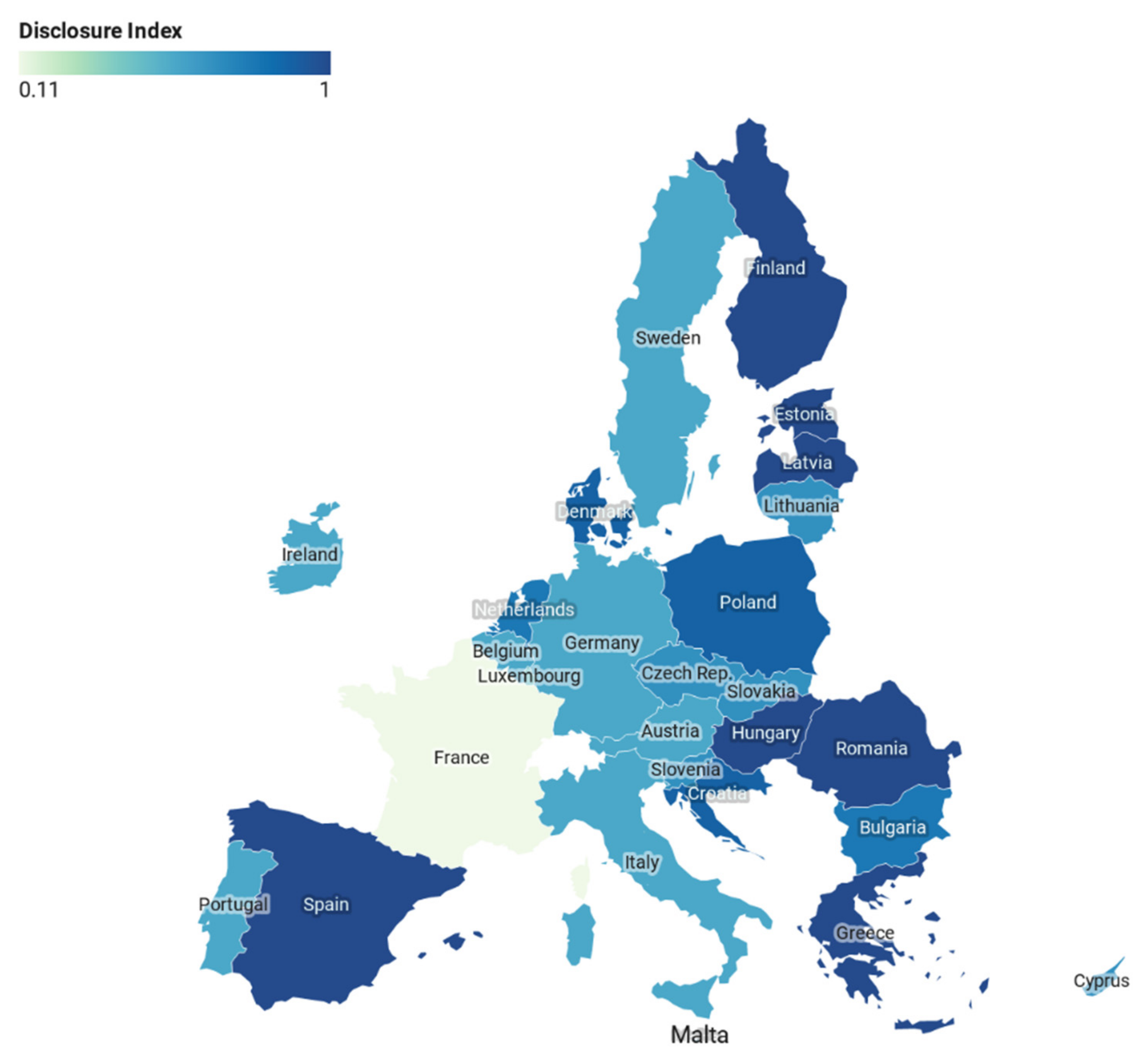

Sustainability Free Full Text Harmonisation And Emergence Concerning The Performance Audit Of The Eu Member States Public Sector Romania S Case Html

Travel Nurse Irs Audit Why They Occur And What To Expect

How Often Do Travel Nurses Get Audited Tns

4 Must Know Rules To Tax Free Money As A Travel Nurse Nomadicare

Business Man And Invoice Flickr Intercambio De Fotos Bookkeeping Accounting Services Bookkeeping Services

How To Survive An Irs Audit Tax Time Irs Insurance Investments